Unfortunately, pensions became a huge danger to employers for several reasons, here are just a few:

- People started to live longer, costing employers to pay out much more than expected.

- Market volatility became greater than projected causing employers to be inadequately prepared. For example, during initial forecasts, employers anticipated earning a certain amount on the money they put away per employee and as that amount that was put away grew, they would have plenty of money to pay the guaranteed retirement. Regrettably, the actual return on investment was far less than the initial projected return leaving the employer accounts severely underfunded.

- Global competition and employment. Companies like IBM, Verizon Communications, Delta Airlines, The Boeing Company, General Motors, American Airlines and thousands more were forced to compete with new rivals who didn’t bear the cost of old-style benefits and that is why each of the aforementioned companies eventually “restructured” or eliminated their pension plans.

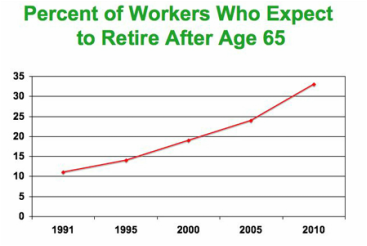

This graph summarizes information from the Employee Benefit Research Institute's 2010 Retirement Confidence Survey (RCS)

This graph summarizes information from the Employee Benefit Research Institute's 2010 Retirement Confidence Survey (RCS) The 401(k) plan was intended to be a savings plan that was offered in addition to a pension plan.

A game changer occurred in 1986 when Congress replaced the defined benefit plan for federal civilian workers with a far less generous defined benefit plan and a 401(k)-type plan. This was seen as an endorsement of the 401(k) and since that time, 401(k) plans have become the fastest-growing type of retirement plan in the United States.

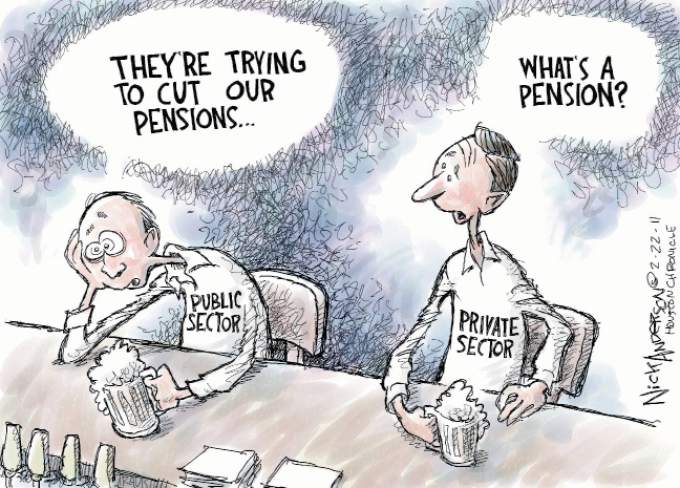

Due to the risks associated with defined benefits virtually all employers that offered pensions have significantly modified them to be far less favorable, no longer provide defined benefits to new employees hired after a cutoff date, or have gotten rid of them all together. Today, 94% of private employers offer a 401(k). 401(k)s, which were never designed to be the primary method of saving for retirement, have now become just that.

The old way of doing business, guaranteeing employees an income for life, became too challenging, costly, and unpredictable. Now the game has changed. It is entirely up to the employee to invest for his/her retirement. So, how have 401(k)’s performed since they began nearly 40 years ago? The short answer…not too good.

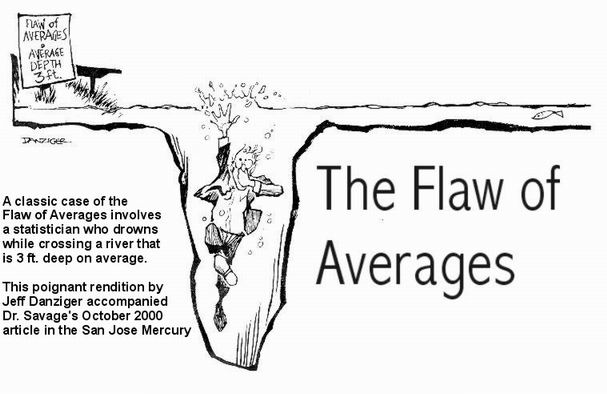

According to Fidelity, one of the largest 401(k) providers in the world, the average 401K balance is now around $91,800 as of 7/1/2015. Vanguard, another large 401(k) provider, boasts and average 401(k) balance of $101,650. According to Fidelity, about half of a percent (0.5%) of Fidelity 401(k) participants have hit the $1 million mark. On average the 401(k) millionaires contributed 14% of their pay (not including company matching), worked at their company for more than 30 years, and made less than $150,000 per year.

The statistics are shocking. According to the U.S. Census Bureau and Bankrate, more than 99% of people age 65 today have less than $1 million in retirement savings. One million dollars isn’t what it use to be and still most Americans will never achieve it in their 401(k).

The Government Accountability Office (GAO) recently released a report on mega-IRA’s, IRAs in excess of $5 million. The GAO figures if someone had maxed out every year from 1975-2011, invested in an S&P index fund (which returned an average of about 8 percent annually), and never withdrew a dime, they’d have about $353,000.

Most 401(k)s are riddled with mutual funds. A mutual fund is simply a basket of stocks with an added management fee. The initial concept was to have a fund professionally managed by experts that chose only the “winners” and because it’s a basket of stocks, you could buy one fund and now you were “diversified”. For example, let’s say that the ABC Technology Fund consists of 20% Apple stock, 20% Google stock, 20% IBM stock, 20% Amazon stock, 20% Microsoft stock, and let’s not forget the ABC Technlogy Fund “management fee”. By circumventing the ABC Technology Fund and buying the exact same stocks outright, you would eliminate the management fee thereby guaranteeing you to always outperform the ABC Technology Fund. This is why no billionaire on earth uses mutual funds as a wealth building strategy and also why the owners of Fidelity, one of the largest mutual fund companies in America, own no mutual funds themselves. Unfortunately, mutual funds are here to stay because whether you win or lose, the mutual fund manager makes a profit because of the built-in fee; a fee that most people don’t even realize exists. Again, the point of a mutual fund is to outperform the general stock market by only picking the winners, so why is it acceptable that 94% of the time mutual funds UNDERperform the stock market (e.g. mutual funds virtually always underperform major indices like the S&P 500 or the Dow Jones)? How do you get ahead when you’re ALWAYS underperforming? To be clear, I believe the single greatest threat to the success of the 401(k) saver is the investments he/she has to pick from inside of his/her 401(k) plan.

So how do we fix this? Should we all avoid 401(k)s? What can we do?

A great alternative to a 401(k) is to start a self-directed 401(k) and/or IRA. You can rollover your money from your current 401(k), without penalties or tax consequences, into a self-directed plan and from that self-directed plan you can invest in virtually anything including physical gold and real estate. Let me be clear, you’re not withdrawing the money, you’re rolling it over. If you’re one of those that believes the 401(k) plan is good enough as is, imagine rolling over your money to a self-directed plan and mirroring your previous 401(k) by purchasing all the same stocks outright and eliminating the mutual fund fee…an instant gain. Even the most skeptical or so-called conservative investor could benefit greatly from using a self-directed plan. If your current 401(k) will not let you rollover while still employed with them, contact me and I’ll show you other legal and acceptable ways around it.

I’m sure you’re aware that more millionaires have been created in real estate than in any other industry. So why not invest in real estate? Why gamble on mutual funds? Warren Buffett does not invest in mutual funds. John C. Bogle, founder and former CEO of the Vanguard Group, one of the world’s largest mutual fund companies, does not invest in mutual funds. Bogle says, “96% of all mutual funds don’t match the market over any ten year period.” Ouch. The founder of one of the largest mutual fund companies in the world openly speaks against mutual funds yet most middle-class Americans still believe mutual funds are how you “play it safe”.

Facebook cofounder Dustin Moskovitz has earned over $95 million in his self-directed Roth IRA [a Roth is tax-free retirement account].

Mitt Romney recently ran for president and he had amassed $100 million in his self-directed IRA. Let me let you in on a secret, he didn’t amass that type of wealth using mutual funds.

The point is, if you want to amass real wealth in your retirement account you have to take a look at using an account that will allow you to invest in assets that have a track record for creating millionaires like real estate. The starting point is to get educated. Understand what a self-directed 401(k) and/or IRA is and the very many ways to use it to your advantage. Also, learn from others that have had success in their self-directed accounts.

If you’d like to learn about proven real estate strategies and how to start on the fast track to wealth be sure to attend our next event.

RSS Feed

RSS Feed