---Zimbabwe Billionaire---

---Zimbabwe Billionaire--- In the year 2000, the National Debt for the U.S. was $5.6 trillion. From a different perspective, it took 224 years (the U.S was founded in 1776) to amass $5.6 trillion of debt. By 2008, our national debt soared to $10.2 trillion; in only 8 years we doubled a debt that took 42 presidents, a great depression, two world-wars, and several other notable events to accumulate. The response to this shocking truth (and the 2008 financial crisis) was to print U.S. Dollars; solve the financial problems by printing money out of thin air and paying it off. Before 2013 ends, our national debt will have exceeded $17 trillion and, to stimulate the economy, the Federal Reserve is currently printing [quantitative easing] U.S. Dollars at a rate equivalent to $1 TRILLION per year.

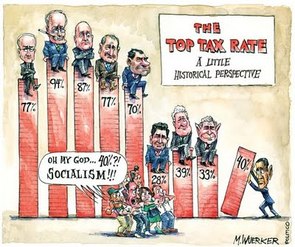

---The U.S. Top Tax Rate Average is 61%.---

---The U.S. Top Tax Rate Average is 61%.--- 1.) Raise taxes drastically (the top tax rate in the U.S. in the 1950s was 90%!) to help pay off the new debt over time, A VERY UNPOPULAR CHOICE or

2.) Borrow more money [to pay the minimum payment on existing debt and meet the minimum obligations (e.g. social security, unemployment benefits, etc.)] AND print money [to stimulate the economy].

It’s a much greater challenge to raise the tax rate to more than double what it is today and would cause a huge uprising from American citizens. Option 1: Imagine the uproar if a citizen that earned $100,000 was ordered to pay 50% in taxes which would only leave him/her with $50,000 of purchasing power. Option 2: A near equivalent alternative would be to allow the citizen to pay the same 28% in taxes that he/she did before the crisis and debt surge which would leave the citizen with $72,000 after tax; AND print money possibly risking the $72,000 to eventually only be able to purchase $50,000 worth of goods, a “silent tax” of $22,000 or more WITHOUT uproar. In option 1 and 2 the citizen is left with $50,000 of after tax purchasing power, however, option 2 goes virtually unnoticed by most citizens and is therefore an easier option to implement.

Some inflation is natural in a healthy economy. However, when an entity can literally print currency out of thin air they can simultaneous create unhealthy levels of inflation which severely lowers YOUR purchasing power similar to how a typical tax lowers your purchasing power. Consider the devastating effects of inflation during 1978 to 1981 in the U.S., a time when inflation averaged 13.5% per year. That means that $100,000 safely tucked away in 1978 could only buy $59,000 worth of goods by 1982!

In short, one thing is for sure, inflation will continue over time. The good news is there are ways to hedge [protect] yourself from inflation. We always discuss disputably the greatest inflation hedge of all time at each of our events. Attend one of our events or give us a call to learn how to BEST beat the silent tax.

RSS Feed

RSS Feed