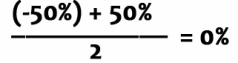

According to Investopedia a return on investment (ROI) “is a performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. To calculate ROI, the benefit (return) of an investment is divided by the cost of the investment; the result is expressed as a percentage or a ratio.” The return on investment formula:

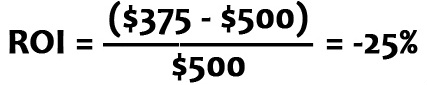

“Average” Returns vs “Annualized” Returns

In short, when calculating the average return, Investment A that has a yearly return of 11% may actually have performed worse than Investment B that has a yearly return of 10%, if Investment A had a negative/s year/s and investment B did not. To get a true apples to apples comparison AND the actual return of an investment make sure to use the annualized return method of calculation.

True investing makes sense. Learn how actual returns can really help you achieve financial security by attending one of our events.

| Click the image to the right to learn more about the annualized return and how it is calculated. Click here to use a CAGR calculator (you will be directed offsite). |

RSS Feed

RSS Feed